Another month down. Hard to believe 4 months have flown by. That means it’s time to look at my dividends and portfolio.

Dividends continue to come in they are the one thing that is basically constant a steady rising dividend income.

Dividends came in over $1000 this month. Because of Easter weekend BAC didn’t show up till April and one stock MGIC didn’t pay and MPW payed in May this is the second straight $1000 dollar month

Compared to last April my dividend income is 13.45 percent higher. Total for year is 12.5 percent higher. Trying to keep that above 15 percent for the year so have some work to do.

My PADI hit $15,000 again thanks to GOOG surprise dividend announcement. It will start paying a dividend in June which will be a big boost to my June dividends. The GOOG dividend announcement pushed my dividend raises back into positive territory for the year. OMF had a dividend announcement on April 30.

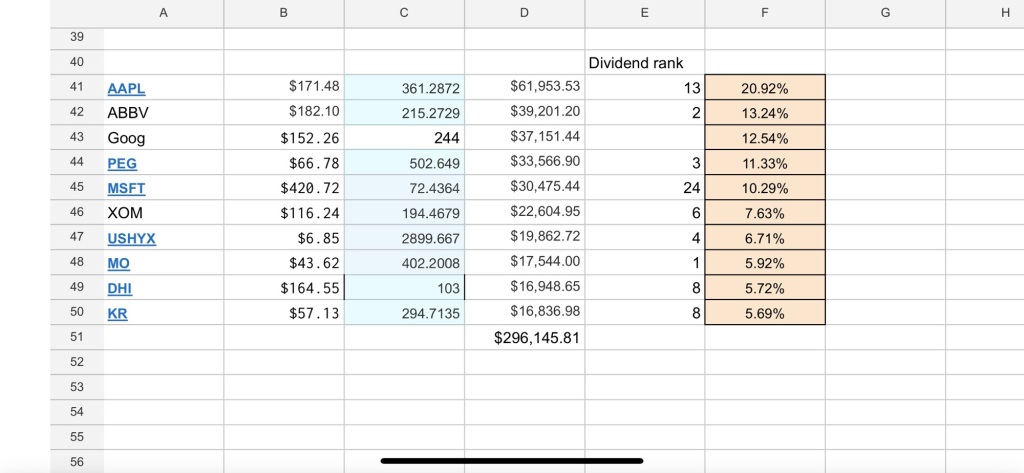

I forgot to swap 2 positions that switched but you can see them here. This total is 60.95 percent of my total portfolio value. The value dropped almost $5,000 from last month. But ironically my total portfolio value only fell about $600.00 dollars give a few dollars any way.

The seeds I planted are really starting to sprout. You can see the results month by month. Year by year.

Total portfolio value $478,899.65. Forward annual dividend $15,254.75.

Trailing 12 months of Dividends $14,967.48. Expected dividend as of 2024 $14,452.24.

Net worth as of March 24 $717,885.70.

Sells

Bought KR, FLO, TGT, SBUX, AAPL, USHYX. Dividend cuts none. Dividend raises GOOG, and OMF.

Future goals

Future portfolio value of $500,000.00

Forward annual dividends of $17,500.00

Future net worth $750,000. This month I went over $76,000 in lifetime dividends.

As I wrap this months report up I’m very pleased with everything. This shows that no matter what you can do the same as I have done and the earlier you start the better off you will be. Just constant buying good quality stocks that raise their value and raise their dividends